The employment report is out. It is a great report. It is easy to understand why the GOP is not talking about it. The question is why are Democrats so subdued about it? The answer is rather simple. It is all about the 2016 election narrative.

May employment report

If the Republican narrative is to be believed, President Obama’s economy must be placed in the most negative light. Unfortunately, because of a very successful two years, there was enough fuel placed in the economy to allow a recovery, not a steady recovery, but enough fiscal policy to prevent any severe recession.

Democrats do not want the American people to believe that the status quo has lead to a fairly good economy. They want to run on a narrative that sans Republican obstruction, the economy would be soaring. If they talk about an improving job market, they fear it takes that narrative off the table. If that narrative is gone, they play on the Republican’s turf, hot button issues like Benghazi, email servers, and other issues that have no value to the average Americans.

The problem is that that is a false choice. While the employment numbers are improving, the middle-class remains in distress. Income and wealth inequality is real. The theft of our treasure by the plutocracy is real.

If Democrats had a robust spine and if they believed in the American people, they would put their efforts in the difficult task of talking to and educating the American people at large. They have already won the social issues debate. The real economic debate is waiting for someone to put it out there.

THE EMPLOYMENT SITUATION – MAY 2015

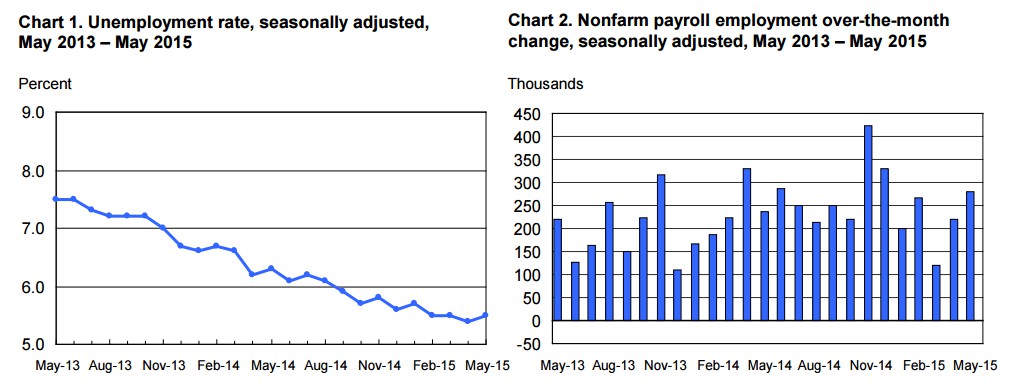

Total nonfarm payroll employment increased by 280,000 in May, and the unemployment rate was essentially unchanged at 5.5 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in professional and business services, leisure and hospitality, and health care. Mining employment continued to decline.

Household Survey Data

In May, both the unemployment rate (5.5 percent) and the number of unemployed persons (8.7 million) were essentially unchanged. Both measures have shown little movement since February. (See table A-1.)

Among the major worker groups, the unemployment rates for adult men (5.0 percent), adult women (5.0 percent), teenagers (17.9 percent), whites (4.7 percent), blacks (10.2 percent), Asians (4.1 percent), and Hispanics (6.7 percent) showed little or no change in May. (See tables A-1, A-2, and A-3.)

The number of unemployed new entrants edged up by 103,000 in May but is about unchanged over the year. Unemployed new entrants are those who never previously worked. (See table A-11.)

The number of persons unemployed for less than 5 weeks decreased by 311,000 to 2.4 million in May, following an increase in April. The number of long-term unemployed (those jobless for 27 weeks or more) held at 2.5 million in May and accounted for 28.6 percent of the unemployed. Over the past 12 months, the number of long-term unemployed is down by 849,000. (See table A-12.)

In May, the civilian labor force rose by 397,000, and the labor force participation rate was little changed at 62.9 percent. Since April 2014, the participation rate has remained within a narrow range of 62.7 percent to 62.9 percent. The employment-population ratio, at 59.4 percent, was essentially unchanged in May. (See table A-1.)

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) was about unchanged at 6.7 million in May and has shown little movement in recent months. These individuals, who would have preferred full-time employment, were working part time because their hours had been cut back or because they were unable to find a full-time job. (See table A-8.)

In May, 1.9 million persons were marginally attached to the labor force, down by 268,000 from a year earlier. (The data are not seasonally adjusted.) These individuals were not in the labor force, wanted and were available for work, and had looked for a job sometime in the prior 12 months. They were not counted as unemployed because they had not searched for work in the 4 weeks preceding the survey. (See table A-16.)

Among the marginally attached, there were 563,000 discouraged workers in May, down by 134,000 from a year earlier. (The data are not seasonally adjusted.) Discouraged workers are persons not currently looking for work because they believe no jobs are available for them. The remaining 1.3 million persons marginally attached to the labor force in May had not searched for work for reasons such as school attendance or family responsibilities. (See table A-16.)

Establishment Survey Data

Total nonfarm payroll employment rose by 280,000 in May, compared with an average monthly gain of 251,000 over the prior 12 months. In May, job gains occurred in professional and business services, leisure and hospitality, and health care. Employment in mining continued to decline. (See table B-1.)

Professional and business services added 63,000 jobs in May and 671,000 jobs over the year. In May, employment increased in computer systems design and related services (+10,000). Employment continued to trend up in temporary help services (+20,000), in management and technical consulting services (+7,000), and in architectural and engineering services (+5,000).

Employment in leisure and hospitality increased by 57,000 in May, following little change in the prior 2 months. In May, employment edged up in arts, entertainment, and recreation (+29,000). Employment in food services and drinking places has shown little net change over the past 3 months.

Health care added 47,000 jobs in May. Within the industry, employment in ambulatory care services (which includes home health care services and outpatient care centers) rose by 28,000. Hospitals added 16,000 jobs over the month. Over the past year, health care has added 408,000 jobs.

Employment in retail trade edged up in May (+31,000). Over the prior 12 months, the industry had added an average of 24,000 jobs per month. Within retail trade, automobile dealers added 8,000 jobs in May.

Construction employment continued to trend up over the month (+17,000) and has increased by 273,000 over the past year.

In May, employment continued on an upward trend in transportation and warehousing (+13,000). Truck transportation added 9,000 jobs over the month. Making sure that the trucks meet all the standards set for a fleet, companies like Lytx can help with DOT compliance and other essential needs.

In May, employment continued to trend up in financial activities (+13,000). Over the past 12 months, the industry has added 160,000 jobs, with about half of the gain in insurance carriers and related activities.

Employment in mining fell for the fifth month in a row, with a decline of 17,000 in May. The loss was in support activities for mining. Employment in mining has decreased by 68,000 thus far this year, after increasing by 41,000 in 2014.

Employment in other major industries, including manufacturing, wholesale trade, information, and government, showed little change over the month.

The average workweek for all employees on private nonfarm payrolls remained at 34.5 hours in May. The manufacturing workweek was unchanged at 40.7 hours, and factory overtime remained at 3.3 hours. The average workweek for production and nonsupervisory employees on private nonfarm payrolls edged up by 0.1 hour to 33.7 hours. (See tables B-2 and B-7.)

In May, average hourly earnings for all employees on private nonfarm payrolls rose by 8 cents to $24.96. Over the year, average hourly earnings have risen by 2.3 percent. Average hourly earnings of private-sector production and nonsupervisory employees rose by 6 cents to $20.97 in May. (See tables B-3 and B-8.)

The change in total nonfarm payroll employment for March was revised from +85,000 to +119,000, and the change for April was revised from +223,000 to +221,000. With these revisions, employment gains in March and April combined were 32,000 more than previously reported. Over the past 3 months, job gains have averaged 207,000 per month.

- Employment Situation Summary Table A. Household data, seasonally adjusted

- Employment Situation Summary Table B. Establishment data, seasonally adjusted

- Employment Situation Frequently Asked Questions

- Employment Situation Technical Note

- Table A-1. Employment status of the civilian population by sex and age

- Table A-2. Employment status of the civilian population by race, sex, and age

- Table A-3. Employment status of the Hispanic or Latino population by sex and age

- Table A-4. Employment status of the civilian population 25 years and over by educational attainment

- Table A-5. Employment status of the civilian population 18 years and over by veteran status, period of service, and sex, not seasonally adjusted

- Table A-6. Employment status of the civilian population by sex, age, and disability status, not seasonally adjusted

- Table A-7. Employment status of the civilian population by nativity and sex, not seasonally adjusted

- Table A-8. Employed persons by class of worker and part-time status

- Table A-9. Selected employment indicators

- Table A-10. Selected unemployment indicators, seasonally adjusted

- Table A-11. Unemployed persons by reason for unemployment

- Table A-12. Unemployed persons by duration of unemployment

- Table A-13. Employed and unemployed persons by occupation, not seasonally adjusted

- Table A-14. Unemployed persons by industry and class of worker, not seasonally adjusted

- Table A-15. Alternative measures of labor underutilization

- Table A-16. Persons not in the labor force and multiple jobholders by sex, not seasonally adjusted

- Table B-1. Employees on nonfarm payrolls by industry sector and selected industry detail

- Table B-2. Average weekly hours and overtime of all employees on private nonfarm payrolls by industry sector, seasonally adjusted

- Table B-3. Average hourly and weekly earnings of all employees on private nonfarm payrolls by industry sector, seasonally adjusted

- Table B-4. Indexes of aggregate weekly hours and payrolls for all employees on private nonfarm payrolls by industry sector, seasonally adjusted

- Table B-5. Employment of women on nonfarm payrolls by industry sector, seasonally adjusted

- Table B-6. Employment of production and nonsupervisory employees on private nonfarm payrolls by industry sector, seasonally adjusted(1)

- Table B-7. Average weekly hours and overtime of production and nonsupervisory employees on private nonfarm payrolls by industry sector, seasonally adjusted(1)

- Table B-8. Average hourly and weekly earnings of production and nonsupervisory employees on private nonfarm payrolls by industry sector, seasonally adjusted(1)

- Table B-9. Indexes of aggregate weekly hours and payrolls for production and nonsupervisory employees on private nonfarm payrolls by industry sector, seasonally adjusted(1)

- Access to historical data for the “A” tables of the Employment Situation Release

- Access to historical data for the “B” tables of the Employment Situation Release

- HTML version of the entire news release