By Dean Baker The main economic story of the last four decades is the massive upward redistribution of income that has taken place. The top 1 percent’s share of national income has more than doubled over this period, from roughly 10 percent in the late 1970s to over 20 percent today. And this is primarily a before-tax income story: The rich have used their control over the levers of economic power to ensure that an ever-larger share of the country’s wealth goes into their pockets. (Yes, this is the topic of my book, Rigged.) (It’s free.) Anyhow, the rich don’t want people paying attention to these policies (hey, they might try to change them), so they endlessly push out nonsense stories to try to divert the public’s attention from how they structured the rules to advance their interests. And, since the rich own the newspapers, they can make sure that we hear these stories. This meant that last week the New York Times (3/28/17) gave us the story of how robots are taking all the jobs and driving down wages. Never mind that productivity growth is at its slowest pace in the last seven decades (Beat the Press, 3/19/17). Facts and data don’t matter in the alternative world, where we try to divert folks’ attention from things like the Federal Reserve Board (who are not robots, last I checked) raising interest rates to make sure that we don’t have too many jobs.  One of the other big alternative facts for the diverters is the generational story. This is the one where we tell folks to ignore all those incredibly rich people with vast amounts of money-the reason most people are not seeing rising living standards is the damn Baby Boomers who expect to get Social Security and Medicare, just because they paid for it. The Boston Globe (2/26/17) gave us this story with a piece by Bruce Cannon Gibney, conveniently titled “How the Baby Boomers Destroyed Everything.” (Full disclosure: I am one of those Baby Boomers.) There is not much confusion about the nature of the argument, only its substance. Gibney complains about

One of the other big alternative facts for the diverters is the generational story. This is the one where we tell folks to ignore all those incredibly rich people with vast amounts of money-the reason most people are not seeing rising living standards is the damn Baby Boomers who expect to get Social Security and Medicare, just because they paid for it. The Boston Globe (2/26/17) gave us this story with a piece by Bruce Cannon Gibney, conveniently titled “How the Baby Boomers Destroyed Everything.” (Full disclosure: I am one of those Baby Boomers.) There is not much confusion about the nature of the argument, only its substance. Gibney complains about

the unusual prevalence of sociopathy in an unusually large generation. How does that disorder manifest? Improvidence is reflected in low levels of savings and high levels of bankruptcy. Deceit shows up as a distaste for facts, a subject on display in everything from Enron’s quarterly reports to daily press briefings. Interpersonal failures and unbridled hostility appeared in unusually high levels of divorce and crime from the 1970s to early 1990s.

Starting with the bankruptcy story, the piece to which Gibney helpfully linked noted a doubling of bankruptcy rates for those over 65 since 1991. More and more individuals are hiring an attorney for bankruptcy reasons as they’ve found themselves in so much debt with no means of paying off that debt. It also reported:

Expensive healthcare costs from a serious illness before a patient received Medicare and the inability to work during and after a serious illness are the prime contributors to financial crises among those 55 and older.

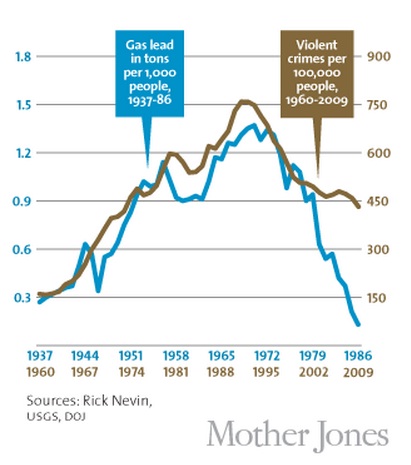

Yes, we have clear evidence of a moral failing here.  The crime rate story is interesting. We had a surge in crime beginning in the 1960s and running through the 1980s, with a sharp fall beginning in the 1990s. Gibney would apparently tie this one to the youth and peak crime years of the Baby Boomers. There is an alternative hypothesis for which there is considerable evidence: exposure to lead. While the case is far from conclusive, it is likely that lead exposure was an important factor. More importantly, the point is that crime was a story of what was done to Baby Boomers, not just kids acting badly. I really like the complaint about the low level of savings among Baby Boomers. I guess Gibney is the Boston Globe‘s Rip Van Winkle who missed the housing bubble collapse and resulting recession. A main complaint among economic policy types in the last decade has been that people were not spending enough. The argument was that people were being too cautious in the wake of the crash, and not spending the sort of money needed to bring the economy back to full employment. But Gibney wants to blame Baby Boomers for spending too much. Oh well, it’s alternative facts day at the Boston Globe! The rest of the piece is in the same vein. Boomers are blamed for “unaddressed climate change.” Well, Boomers also were the force behind the modern environmental movement. Many of us Boomers might look more to folks like ExxonMobil and the Koch brothers who have used their vast wealth to try to stifle efforts to combat climate change-but hey, why focus on rich people acting badly when we can blame a whole generation? Gibney blames Boomers for every bad policy of the last four decades, including the war on crime, which took off in the late 1970s, when many of the Boomers had not even reached voting age. We even get blamed for the repeal of Glass-Steagall, another great generational cause. The amount of confusion in this piece is impressive. We get this one:

The crime rate story is interesting. We had a surge in crime beginning in the 1960s and running through the 1980s, with a sharp fall beginning in the 1990s. Gibney would apparently tie this one to the youth and peak crime years of the Baby Boomers. There is an alternative hypothesis for which there is considerable evidence: exposure to lead. While the case is far from conclusive, it is likely that lead exposure was an important factor. More importantly, the point is that crime was a story of what was done to Baby Boomers, not just kids acting badly. I really like the complaint about the low level of savings among Baby Boomers. I guess Gibney is the Boston Globe‘s Rip Van Winkle who missed the housing bubble collapse and resulting recession. A main complaint among economic policy types in the last decade has been that people were not spending enough. The argument was that people were being too cautious in the wake of the crash, and not spending the sort of money needed to bring the economy back to full employment. But Gibney wants to blame Baby Boomers for spending too much. Oh well, it’s alternative facts day at the Boston Globe! The rest of the piece is in the same vein. Boomers are blamed for “unaddressed climate change.” Well, Boomers also were the force behind the modern environmental movement. Many of us Boomers might look more to folks like ExxonMobil and the Koch brothers who have used their vast wealth to try to stifle efforts to combat climate change-but hey, why focus on rich people acting badly when we can blame a whole generation? Gibney blames Boomers for every bad policy of the last four decades, including the war on crime, which took off in the late 1970s, when many of the Boomers had not even reached voting age. We even get blamed for the repeal of Glass-Steagall, another great generational cause. The amount of confusion in this piece is impressive. We get this one:

From 1989 to 2013, wealth gaps between older and younger households grew in the same way as those between the top 5 percent and the bottom 95 percent. Today’s seniors (Boomers) are much wealthier relative to the present young than the seniors of the 1980s were to then-young boomers. All those tax breaks, bailouts, easy money, deregulation, and the bubbles they spawned supported that Boomer wealth accumulation while shifting the true costs to the future, to the young.

Wealth is a virtually meaningless measure for the young. Gibney is crying for the Harvard Business school grad with $150,000 in debt. Young people do have too much debt, though this can often be solved by looking at options such as debtconsolidation.loans, which could help remove some of the stress often associated with serious debts. Debt consolidation helps to make all your payments more manageable by combining them and spreading the payments out over a longer period – more information here. However, the bigger issue is the horrible labor market they face (partly the result of Boomers saving too much money). Furthermore, while the ratio of Boomer wealth to wealth of the young has risen (because of college debt), the typical Boomer reaching retirement actually has less wealth than their parents. It’s also important to remember in these comparisons that Boomer parents likely had a traditional pension (an income stream that does not get included in most wealth measures). If Boomers are to have any non–Social Security income in retirement, it will likely be in the form of a 401(k) that does count as wealth. And, of course, we get the completely meaningless national debt horror story:

Still, no amount of tax reallocation could keep the government together and goodies flowing, so Boomers tolerated astounding debt expansion while chopping other parts of the budget. Gross national debt, 35 percent of GDP when the Boomers came of age, is now 105 percent, a peacetime record, expanding 3 percent annually, forever.

Economics fans would note that interest on the debt (net of money refunded by the Federal Reserve Board) is around 0.8 percent of GDP, near a post-war low. They would also point out that formal borrowing is just one way in which the government can create obligations for the future. The government also pays for things like innovation and creative work with patent and copyright monopolies. These monopolies effectively allow their owners to impose taxes on consumers. Due to these monopolies, we will pay $440 billion on prescription drugs this year for drugs that would likely sell for less than $80 billion in a free market. The difference of $360 billion is more than twice the net interest burden of the debt that Gibney wants us to worry about. And this is just patent protection for prescription drugs; the costs for the full range and patent and copyright monopolies throughout the economy would almost certainly be two or three times as large. Of course, Gibney could also blame the commitment of these monopoly rents on Baby Boomers (after all, people elected by Baby Boomers were the ones who made these monopolies stronger and longer), but that might be a bit hard to sell. It would look pretty obvious that the story is one of a massive upward redistribution to the rich-some of whom happen to be Baby Boomers-and that would undermine the whole effort at distraction in which Gibney and the Globe is engaged.

Economist Dean Baker is co-director of the Center for Economic and Policy Research in Washington, DC. A version of this post originally appeared on CEPR’s blog Beat the Press (3/30/17). Messages to the Boston Globe can be sent to [email protected] (or via Twitter: @BostonGlobe). Please remember that respectful communication is the most effective.